Who is CIG?

A Distressed Workforce Housing Investor and Real Asset Operator

Clear Investment Group (“CIG”) is a real estate investment and operating firm with a singular focus: distressed workforce housing.

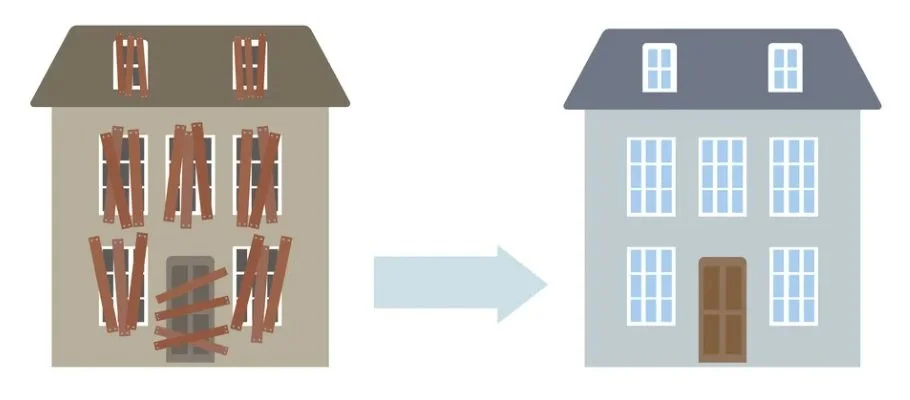

Specializing in acquiring and repositioning deeply distressed, operationally challenged multifamily assets through a special situations credit approach—targeting opportunities where strong management, disciplined capital structures, and operational expertise can create meaningful value.

CIG is not a passive investor. We are a vertically integrated real asset operator, built to take control of complex situations and execute turnaround strategies at the property level.

CIG’s Singular Focus: Distressed Workforce Housing

Workforce housing is one of the most essential segments of the U.S. housing ecosystem—yet it is also one of the most mismanaged and underserved.

CIG targets workforce housing communities that have become distressed due to:

poor or broken property management

deferred maintenance and underinvestment

operational inefficiency

ownership fatigue

market dislocation or capital structure problems

These are often “managerial distress” situations—not broken real estate.

Our edge is operational: we buy assets where strong execution and disciplined management materially changes outcomes.

A Special Situations Credit Mindset in Real Estate

CIG approaches distressed workforce housing with a special situations credit framework, focusing on opportunities with:

deep basis and strong downside protection

distressed pricing + operational upside

mismanagement-driven value creation

clear stabilization pathways

structured risk management

This means we often acquire assets that other buyers avoid—because they require operational intervention, not just capital.

CIG is designed specifically for these high-complexity situations.

Contact us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!